On Saturday, March 17th, 2018 the Mathare Slums Community Association (MaSCA) hosted its first “Women’s Microlending Savings Group” workshop with the ten women members of Mathare Bondeni Recovery. The women’s faction of the Mathare Bondeni Recovery CBO requested for MaSCA coordinator Katie Cashman to organize a workshop on starting a microfinance savings group. Each of the 10 women has her own small business, ranging from selling vegetables to cooking chips and they could benefit greatly from small peer-to-peer loans to make business investments.

Katie invited Memory Orode Rai to conduct the workshop and the results were a huge success. Memory has a background in business administration and finance and conducted a highly engaging workshop, as was evident from the occasional bouts of laughter that could be heard from the workshop room. The workshop was hosted at the Mathare Bondeni Recovery office near to the river and the bridge connecting Bondeni Village to Kosovo Village. The women were interested in learning how to efficiently reinvest and lift their businesses and improve recordkeeping.

Memory explained that the key benefits of peer-to-peer microlending are: The loans have a lower interest rate than at a bank, loans from banks have more regulations and require collateral, and finally, peer-to-peer loans are quick and easy because processing can happen on the same day. The only potential disadvantages are lending defaulters, or those who don’t pay back their loan.

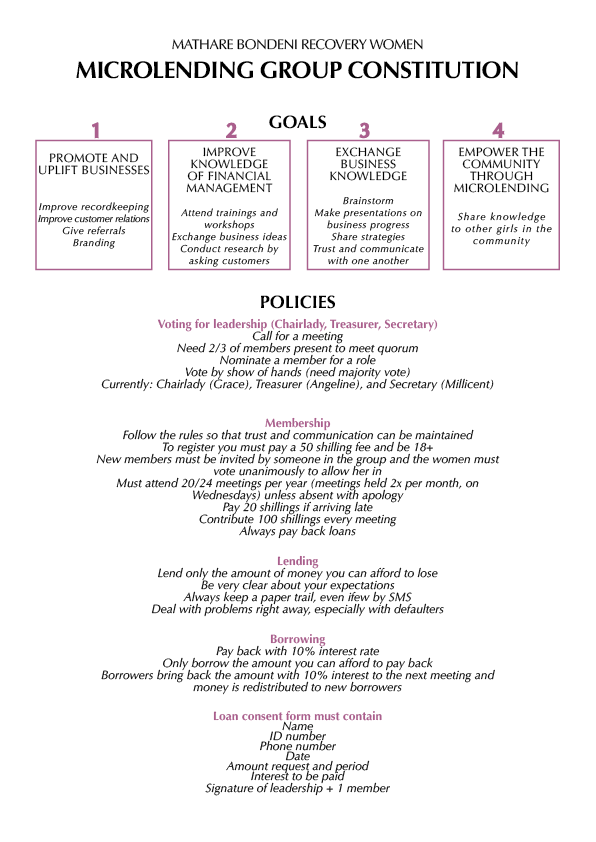

Led by Memory, the Mathare Bondeni Recovery Women’s Microlending Group decided on their goals, their leadership (Chairlady, Secretary, and Treasurer), their lending and borrowing policies, and a Constitution was drafted. Memory also taught the women how to keep an immaculate paper trail by bookkeeping all loan transactions.

The next workshop is scheduled for Saturday April 7 to follow up with the women’s progress in establishing their loan system, and perfecting their bookkeeping techniques. Please contact us at info@mathare.org if you would like to contribute or take part.